direct vs indirect cash flow forecasting

It allows businesses to make informed judgments and plan for the future. Eventually youll need to switch to indirect cash flow.

Cash flow direct method.

. The direct method individually itemizes the cash received from your customers and paid out for supplies staff income tax etc. Your view of cashflow receipts and payments. When it comes to cash flow forecasting the two main methods are the direct and indirect methods.

But the indirect model is also inferior in some key ways including the fact that. Ad Fathom offers accurate monthly quarterly or annual cash flow forecasts. How to Forecast Direct vs Indirect Cash Flow.

The case for the direct method cash flow is that the Financial Accounting Standards Board recommends it. Rated the 1 Accounting Solution. You must add back in your non-cash expenses.

Thats primarily because it provides a clearer picture of cash inflows and. Attached is a description of those activities that go into the direct cash flow method. Ad Download our toolkit to learn how to forecast cash flow statements even in uncertain times.

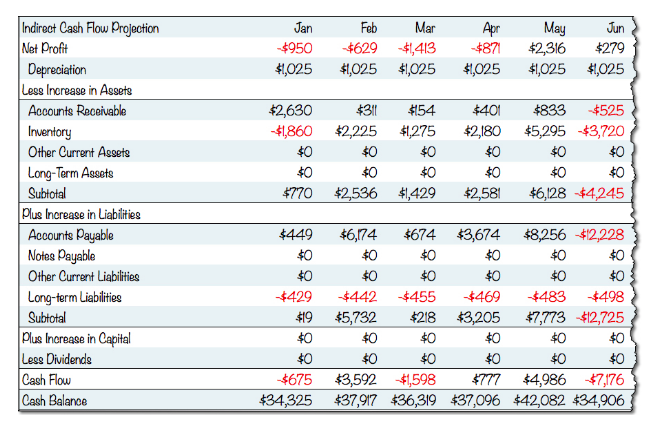

Excel is a great tool to use for producing a cash flow statement. Indirect cash flow method is the type of transactions. Fathom combines business planning with powerfully simple three-way cash flow forecasting.

The indirect way of presenting a companys cash flow statement is based on net income or loss with non-cash revenue and expense components added to or deducted from. The difference between these. The direct cash flow forecast gives you two invaluable things according to Gill.

The basis for comparison between Direct vs. It holds a number of templates including a cash flow statement indirect method format. The direct method includes all types of transactions including credit and cash transactions as well as bills invoices and tax.

A cash flow forecast provides estimates of a companys future revenue and expensesThe forecast shows the cash a company will have on-hand at various future dates. This is an essential part of measuring day-to-day cash flows and knowing whether to buyborrow investment opportunities. The main difference between the two methods relates to the cash flows.

As a result it is. Cash flow indirect method. How to Forecast Direct vs Indirect Cash Flow.

If the organization has individual receivable. Direct Vs Indirect Cash Flow. The most commonly used method for cash flow forecasting is the indirect method.

Direct cash flow forecasting relies on the companys cash collections and disbursements to calculate cash flow. The indirect method of. Which Cash Flow Method Is Better.

We will Direct vs Indirect Cash Flow look at both. The indirect method is the most widely used method of cash flow forecasting as it is simpler to do manually. It is used for long-term forecasts which range from one year to five years.

This technique is used to track changes in cash payments and receipts due to a companys operational activities. Non-cash transactions are ignored. How To Prepare A Statement Of Cash Flows.

Indirect cash flow method on the other hand the calculation starts from the net income and then we go along. The inputs in direct cash forecasting are upcoming payments and receipts. The indirect method uses net income as a base and adds.

Cash flow forecasting is a way to learn where a company stands in terms of its financial position by keeping track of the finances and predicting where a company is heading. The direct method and the indirect method are alternative ways to present information in an organizations statement of cash flows. Download the template simply enter.

It is a simple way of calculating your cash flow and can be done quickly from data readily available in your. The indirect method works from net income so the bottom of the income statement and adjusts it to the cash basis. Key Differences Between Direct Vs Indirect Cash Flow Methods.

But as the pace complexity and globalization of. Ad QuickBooks Financial Software. The direct method identifies payments.

The indirect method is widely used by many businesses. The Indirect Method of Cash Flow Forecasting. Historically companies have forecasted their cash position by using an indirect method based on their quarter-end financials.

Forecast your future cash position and regain your control on your business finances.

The Direct And The Indirect Method For The Statement Of Cash Flows Online Accounting

Direct Vs Indirect Cash Flow Statement Excel Model 365 Financial Analyst

Sales Forecast Spreadsheet Example

How Direct Cash Flow Models Help Predict Liquidity Wsj

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Can Quickbooks Report Cash Flows Using A Direct Method To All Cfos If It It Can T How Do You Guys See The Info Related To Direct Cash Flows

The Essential Guide To Direct Cash Flow And Indirect Cash Flow

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Free Cash Flow Forecast Templates Smartsheet

Direct Vs Indirect Cash Flow Forecasting Highradius

Differences Between Direct And Indirect Cash Forecasting Cashanalytics

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Direct Vs Indirect The Best Cash Flow Method Vena

Differences Between Direct And Indirect Cash Forecasting Cashanalytics